Update of the Parcel Value Reduction Calculations

/Depending on your property tax portfolio, Exemptions and Abatements can be an important part of your valuation process. They can also be confusing, as some jurisdictions give a fixed reduction for a particular exemption category, while others give a percentage off, and some even give a combination of the two. Tracked as “Reductions” in the sigerTax system, these calculations are no longer a hassle.

We are excited to announce that sigerTax now supports the automatic calculation of reductions whether the exemption is a percentage of the assessed value or a fixed amount. By including the exemption, or reduction, in the system, you no longer need to manually override the taxable value in order to calculate the correct tax amounts.

The system has always calculated the taxable value by subtracting the reduction from the assessed value. Now it will also calculate the reduction amount for each of your values. With the Reduction Calculations, the system will automatically and correctly calculate both your current and beginning taxable values. It will also automatically adjust the current amount of the reduction as the parcel’s value changes, thus calculating your taxes and savings correctly.

The sigerTax system supports three methods for calculating the reduction.

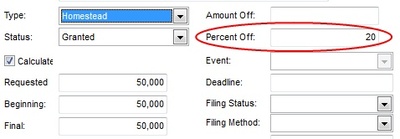

Percent Equation: To find the reduction amount with a fixed percent, the system uses this equation:

Reduction = Assessed Value x (Percent/100)

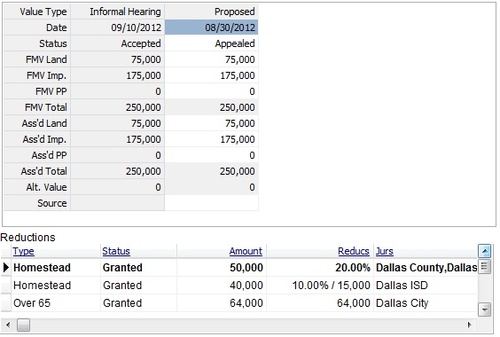

Example: The Dallas County Homestead Exemption is 20% off of the assessed value. For an assessed value of $250,000, the equation is:

Reduction = 250,000 x (20/100) or 50,000.

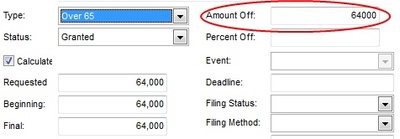

Amount Equation: To find the reduction amount with an amount off, the system uses this equation:

Reduction = Amount Off

Example: The City of Dallas Over 65 exemption is $64,000 off the assessed value. Thus the equation would be:

Reduction = 64,000

This method functions identically as inputting the amount in the Requested, Beginning and Final amount fields. However, by putting the amount in the Amount Off field, the system will automatically update all three fields for you, saving you time.

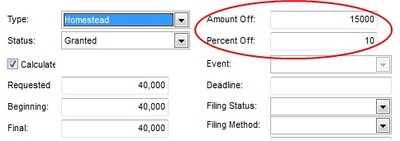

Amount and Percent Equation: To find the reduction amount with a percent and an amount off, the system uses this equation:

Reduction = (Assessed Value x (Percent/100)) + Amount Off

Example: The Dallas ISD Homestead Exemption is 15,000 + 10% off the assessed value. With an assessed value of $250,000, the equation is:

Reduction = (250,000 x (10/100)) + 15,000 or 40,000.

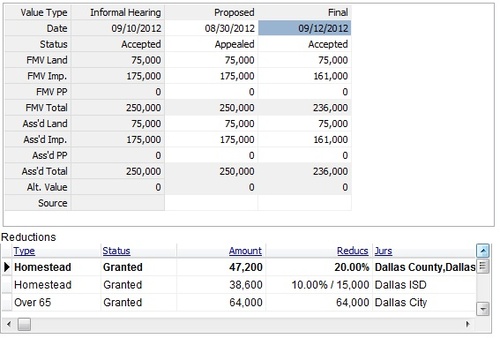

If your assessed value were to change from 250,000 to 236,000, the system will automatically calculate your current value reduction amounts using the new value. The beginning reduction amounts would stay at 50,000, 64,000, and 40,000 respectively. The recalculated reduction amounts would be as follows:

Percent:

Reduction = 236,000 x (20/100) or 47,200

Amount:

Reduction = 64,000

Amount and Percent:

Reduction = (236,000 x (10/100)) + 15,000 or 38,600

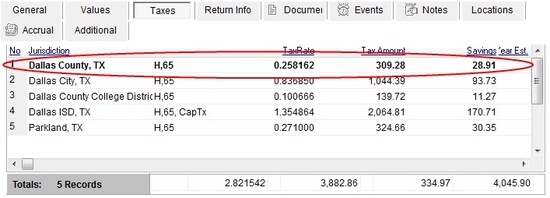

For your convenience, the reductions are marked on the Parcel Tax Record List, with the code of the reduction next to the jurisdiction name. For example, Dallas County would have an H next to it, because it has a Homestead Exemption.

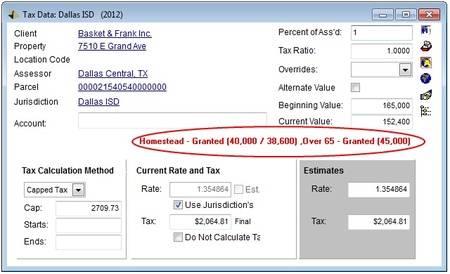

On the Tax Record itself, the type, status, beginning amount and current amount of the reduction can be found in red under the Taxable Value fields.

For more information regarding reductions and to schedule an update, please contact sigercon.