Tax Calculation Methods

/The sigerTax Property Tax system, in addition to the standard tax calculation method that has always been employed in the system, is now able to support fixed rates, fixed taxes, fixed values, capped values, capped rates, and capped taxes.

- A fixed rate will be the tax rate that will be used to calculate the tax amount.

- A fixed value is the taxable value that will be used to calculate the tax amount.

- A fixed tax is the tax amount designated for the parcel.

- A capped value puts a ceiling on the amount of taxable value.

- A capped rate likewise puts a ceiling on the rate to be used in the tax calculations.

- A capped tax is a ceiling on the amount of taxes an account can be charged.

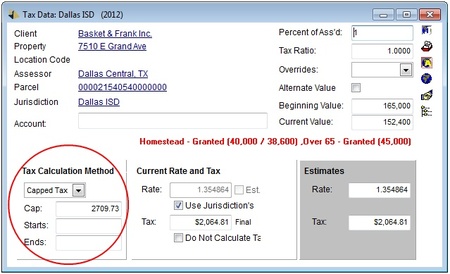

A tax cap occurs when a jurisdiction designates that an account has a cap or ceiling on the amount of taxes that will be paid on that account for a given tax year. For example, Texas law states school district taxes must be capped at the current taxes of the year a person turns 65. By including the tax cap on the tax record within sigerTax, you will no longer have to manually manipulate the tax amount on the tax record to accurately reflect the cap. The system will automatically consider the cap in its calculations.

The standard calculation for value based taxes is:

Tax Amount = Taxable Value x Tax Rate

When a tax is capped, the system considers the cap when determining the account’s actual tax amount.

If the calculated tax amount (tax rate times the taxable value) is less than the capped tax amount, the actual tax amount is the calculated tax that is the tax rate times the taxable value.

Example:

- Capped tax amount: $2,709.73.

- A taxable value of $152,400 and a current tax rate of 1.354864

- The calculated tax amount would be $2,064.81.

- The actual tax amount would be the lesser of the two amounts or $2,064.81.

If the calculated tax amount is more than the capped amount, the system will use the capped amount as the actual tax amount.

Example:

- Capped amount is $2,709.73.

- A taxable value of 152,400 and a current tax rate of 1.875423

- The calculated tax amount would be $2,858.15.

- The actual tax amount would be the lesser of the two amounts, or $2,709.73.

In addition to specifying the tax calculation method, you can now include a start year and an end year related to the tax calculation method. These could be used in conjunction with various tax abatement agreements that have pre-determined expiration dates. The years are referenced when the parcel is rolled forward or back. If the system year into which the parcel is rolled is greater than the system year specified by the end year, the tax calculations will reset to standard and the cap amount removed. It is a good idea to include a start year of possible for reference purposes.

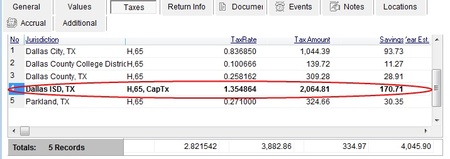

For your convenience, the method of tax calculation associated with a given tax record is now included on the Parcel Tax Record list.

For more information regarding Tax Calculations or to schedule an update, please contact sigercon.